We Will Get You 30 Appointments Booked To Your Calendar Within The First 45 Days.

Our Ai solutions nurture leads, handles client follow-ups, and books warm clients directly to your calendar daily—designed for businesses of all sizes and industries. Save time, boost conversions, and scale smarter.

A Study by Harvard Business Review.

A study by Harvard Business Review confirmed what many sellers would take as a given: your odds of qualifying a lead dramatically decrease the longer you take to respond to them. According to their research, those - odds dropped by an enormous 400% when response time increased from 5 to 10 minutes.

Our Ai Sales System solves this problem ensuring no prospects ever slip through the cracks.

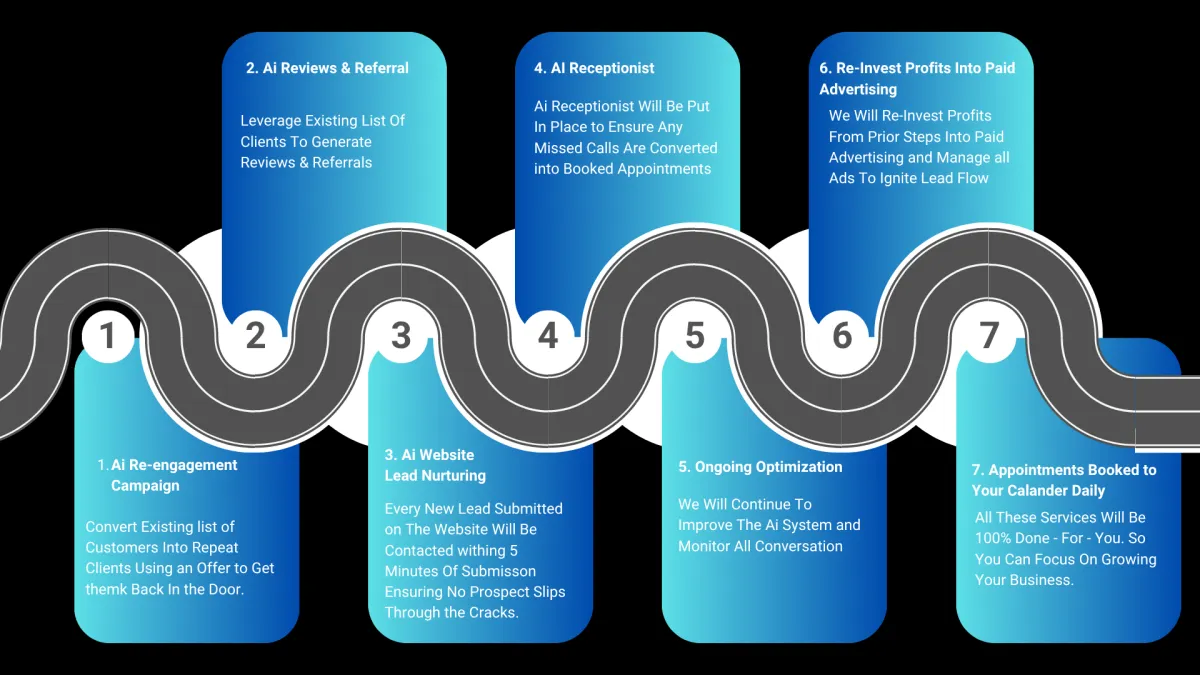

Here's How We Do It.

Our Solution Is AI Agents.

We’ve built an AI-driven agents that works around the clock to keep your customers engaged and your business thriving.

Here’s how it works:

Nurture Leads on Autopilot

Turn prospects into clients with automated drip campaigns, personalized SMS, and smart lead scoring. Our AI keeps leads engaged until they’re ready to buy.

Never Miss a Follow-Up

Stay connected with clients through automated emails, texts, and reminders. Build trust and keep your pipeline flowing without lifting a finger.

Book Warm Clients Instantly

Our AI qualifies leads and schedules high-intent clients directly to your calendar, so you focus on closing deals, not chasing appointments.